Plasterboard Market - Forecast(2020 - 2025)

Plasterboard Market Overview:

According to Eurogypsum, more than 1,600 million square meters of interior surfaces are covered with plasterboards with around 5 million tons of plaster used for interior lining in Europe each year [1]. Similarly, owing to the on-going construction and intermittent replacement of the old plasterboards with the new ones across the globe, the plasterboard market has attained a permanent demand influx from various sectors, and its market size was $19,754 million in 2018, according to the findings by IndustryARC’s market analyst. Furthermore, the analyst estimates the demand for plasterboard to grow with a modest CAGR of 4.6% during the forecast period of 2019 to 2025.

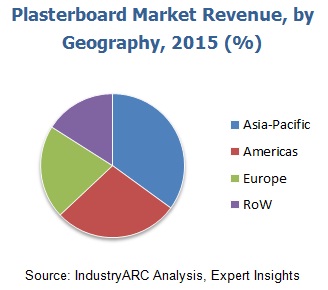

According to the United Nations ESCAP (UNESCAP), in 2013, 60% of the world’s population was attributed to APAC which translates to a whopping 4.3 billion. Even though the organization estimates that the population will observe a growth rate of 0.96% year on year, the population will shoot up to around 5 billion in 2050[2] . Now, this gradual population growth is stirring the construction industry, which is creating a major plasterboard marketplace in the APAC region which held the maximum global market share of more than 36% in 2018, according to the market expert.

Plasterboard Market Outlook:

Plasterboard, also known as drywall, wallboard, sheet rock, gyprock, gypsum board, and gypsum panel is a panel made of calcium sulfate dehydrate (dehydrate). It is widely used in walls and ceiling in various sectors such as residential and commercial. Its leading application segment is in the walls. The partitions and linings of the walls contain plasterboard because it also has soundproofing characteristic.

“The growing construction in the residential and commercial sector coupled with the on-going trend in which consumers from both the sectors have a palpable predilection for the soundproof walls will collective make the plasterboard market boom in the future,” highlights the market analyst in the plasterboard market research report. Furthermore, the analyst estimates the progression in the application CAGR of plasterboard in the walls segment to be 4.9% through to 2025.

Plasterboard Market Growth Drivers:

The Construction Industry Growth –

As mentioned earlier, the plasterboard market is predominantly making strides because of the growing construction industry. The construction industry is further segmented into commercial and residential –

The Population Growth Supporting the Real Estate Business –

By now, it’s discernible that there is a tangible upsurge in the world’s population, and it is only going to grow. This is bringing a seismic shift in the real estate sectors with the latest trend of smart homes which significantly make use of plasterboard.

Economic Growth and the Emergence of New Commercial Buildings –

The world is at the helm of economic progress, and most of the businesses now rely on technology which is leading to new projects in commercial buildings and complexes. Now, these buildings are incorporated with the plasterboard walls, which is further flourishing the plasterboard market.

Dry Construction Technique Gaining Prominence –

Dry Construction Technique (DCT) is 8-10 times lighter than the conventional brick construction technique and also enables 70% savings of the time which also helps the builders in to meet the targets in the turnaround time. Moreover, it reduces the use of water, thereby minimizing the impact of real estate on the environment. Now, this technique is becoming rampant in the real estate sector and leading to a remarkable growth in the demand for plasterboard.

Plasterboard Market Challenges:

The greatest challenge faced by the vendors in the plasterboard market is the fact that the old plasterboards need to be replaced by the new ones, and this is majorly attributed to their vulnerability to water contact. Now, due to the sporadic need for replacement, many customers prefer the conventional methods, and it gets difficult for the vendors to convince them about the advantage of plasterboards. However, the regular services offered by the vendors are making them overcome the challenge.

- In October 2017, the gypsum wallboard and suspended ceilings distributor GMS Inc. acquired all the operating assets of Washing Builder’s Supply Company. This was attributed to GMS Inc.’s vision to position itself in the plasterboard market of Pennsylvania.

- In January 2018, Etex had become the sole shareholder of Pladur which has plasterboard or gypsum wallboard plant near Madrid, and the company is building its second plant at Gelsa.

- North America: The U.S., Canada, Mexico

- South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

- Europe: The U.K., Germany, Italy, France, the Netherlands, Belgium, Spain, Denmark

- APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

- Middle East and Africa: Israel, South Africa, Saudi Arabia

- Give a deep-dive analysis of the key operational strategies with focus on the corporate structure, R&D strategies, localization strategies, production capabilities, and sales performance of various companies

- Provide an overview of the product portfolio, including product planning, development, and positioning

- Discuss the role of technology companies in partnerships

- Explore the regional sales activities

- Analyze the market size and giving the forecast for current and future gypsum boards during the forecast 2018–2023

- Analyze the competitive factors, competitors’ market shares, product capabilities, and supply chain structures

Comments

Post a Comment